☕ OpenAI in talks with Saudi investors for $40 Billion raise & Meta's AI staff flee to rivals despite $2M salaries.

Meta new model teach AI how the physical world works & Apple execs say AI-powered Siri wasn’t “demoware” .

Hot water can freeze faster than cold. It’s called the Mpemba effect, and yes, it makes zero intuitive sense.

Science: 1. Common sense: 0.

Love or hate this intro? Hit reply and tell us why!

📬 What’s in store:

Today’s Picks: Jack Dorsey’s VC advice, Freemium reframed, how Wiz hit 222x, 50+ fund IRRs, startup idea tips, valuation guide, pitch deck & legal templates, and more top founder tools.

Collab Capital, Atlanta-based firm raised $75 Million fund.

OpenAI in talks with Saudi, Indian, and UAE investors for $40B raise.

Apple execs say AI-powered Siri wasn’t “demoware” — just not ready to ship.

Meta's AI staff flee to rivals despite $2M salaries.

Disney and Universal sue Midjourney over alleged AI copyright infringement.

Meta unveils V-JEPA 2 to teach AI how the physical world works.

Snap will start selling AR glasses next year.

Meta adds AI video editing tools to compete with Google and startups.

VC & Startup Jobs: VC & investors backed startup hiring for remote roles.

⏱️ Read Time: 3 minutes

DAILY PICKS

🗞️ What else is brewing

Jack Dorsey’s advice to founders raising venture capital.

Financial modelling template to build your startup financial model that every investor wants to see.

VC RETURNS REVEALED: See IRR Performance for 50+ Venture Funds in 2024.

Reframing “Freemium” by charging the marketing department by a smart bear.

All-In-One guide to pitch deck storytelling - free template & curated resources.

On the Lifecycle of Industries.

Finding the right sales metrics.

Write your monthly investor update (email template download).

Anand Sanwal on how to find startup ideas.

The only startup valuation guide you need as a founder.

Tim Denning on learnings from an 8-figure entrepreneur.

Brian Feroldi shares great advice on selling.

Startup legal document pack – essential legal docs for founders.

CURATED RESOURCES FOR FOUNDERS…

🤝 The Ultimate Resource Hub for Founders…

Your startup’s first investor might already be in your inbox. You just need the right pitch, the right email—and the right list of who to send it to.

We’ve curated the exact resources used by top VCs and breakout founders to raise millions:

Global investor contact databases (US, Europe, India, Africa, Latin America, France, Australia & more)

Pitch deck templates & storytelling guides

Early-stage startup financial models & projections (including SaaS models)

Cap table builder and investor CRM tracker

Legal doc packs, founder agreements, valuation templates, and term sheet guides

Competitor analysis frameworks & investor update templates

VC interview prep guides & data room checklists

Everything you need to pitch smarter, raise faster, and run your startup with confidence.

PARTNERSHIP WITH US

💪 Get your startup in front of over 95,000+ audience

Our newsletter is read by thousands of tech professionals, founders, investors (VCs / Angel Investors) and managers around the world. Get in touch today.

STARTUPS RAISING MILLIONS

💰 Startup funding updates

New Iridium, a Denver, CO-based sustainable chemical company, raised $2.65M in seed funding. The round was led by Radicle Growth and CIRI Ventures, wit participation from Evergreen Climate Innovations, and Climate Insiders.

Outset, a San Francisco, CA-based provider of an AI-moderated research platform, raised $17M in Series A funding. The round was led by 8VC, with participation from new investor Future Back Ventures by Bain & Company and existing investors Y Combinator, Adverb Ventures, Rebel Fund, Genius Ventures, Ritual Capital, and Alt Capital.

Coco Robotics, a Los Angeles-based last-mile delivery robot startup, raised $80 million in new funding. The round included returning angels Sam Altman and Max Altman, along with Pelion Venture Partners, Offline Ventures, and others.

MesoMat, a Hamilton, Ontario, Canada-based startup turning tires into data-rich, connected devices, raised an undisclosed amount in Seed funding. The round was led by Ridgeline with participation from RISC Capital, RPV Global, GTAN, Adrenaline and Starforge Funds, Extra Innings Ventures and others.

Bolo AI, a Palo Alto, CA-based enterprise AI company building intelligent tools for the heavy industry, raised $8.1M in Seed funding. The round was led by True Ventures, with participation from Benchstrength, Accomplice, J Ventures, and Beat Ventures.

FERMÀT, a San Francisco, CA-based provider of an AI-native commerce platform generating brands’ shopping experiences for stronger engagement and conversion, raised $45M in Series B funding. The round was led by VMG Partners, with participation from existing investors QED Investors, Greylock, Bain Capital Ventures, and Courtside Ventures.

Sauz, a Los Angeles, CA-based sauces brand, raised $12M in funding. The round was led by CAVU Consumer Partners, and included investment from existing partners such as Coefficient Capital, Palm Tree Crew and Strand Equity.

Farsight, a NYC-based technology company improving workflows and insights at financial institutions, raised $16M in funding. The round was led by SignalFire, with participation from RRE Ventures, Link Ventures, K5 Ventures and angel investors.

CloudQuery, a NYC-based provider of a developer-first cloud governance platform, raised $16M in funding. The round was led by Partech with participation from Boldstart, Tiger Global and Work-Bench. Reza Malekzadeh, General Partner at Partech, joined the board.

Tracksuit, a NYC-based provider of a brand tracking platform, raised $25M in Series B funding The round was led by VMG Partners, with participation from existing backers Altos Ventures, Footwork, Blackbird, and Icehouse Ventures.

ZeroRISC, a Boston, MA-based provider of silicon supply chain integrity solutions leveraging open-source silicon, raised $10M in Seed funding. The round was led by Fontinalis Partners. Additional participants included Fundomo, Analog Devices co-founder Ray Stata, SemiAnalysis founder Dylan Patel, SBXi, Chelpis, Bond Street LLC, and existing angel investors.

Standard Nuclear, an Oak Ridge, TN-based reactor-agnostic producer of TRISO nuclear fuel, raised $42M in funding. The round was led by Decisive Point with participation from Andreessen Horowitz, Washington Harbour Partners, Welara, Fundomo, and Crucible Capital.

Proxima Fusion, a Munich, Germany-based fusion energy company, raised €130M in Series A funding. The round, which brought total funding to more than €185M in private and public capital, was led by Cherry Ventures and Balderton Capital with participation from UVC Partners, DeepTech & Climate Fonds (DTCF), Plural, Leitmotif, Lightspeed, Bayern Kapital, HTGF, Club degli Investitori, Omnes Capital, Elaia Partners, Visionaries Tomorrow, Wilbe and redalpine.

Finofo, a Calgary, Alberta, Canada-based provider of a financial operations platform helping businesses manage global payments, international receivables, FX, and AP workflows, raised $3.3M in Seed funding. The round was led by Watertower Ventures, with participation from Motivate Venture Capital, SaaS Ventures, and Alberta-based private investors.

Horizon3.ai, a San Francisco, CA-based NodeZero autonomous security platform provider, raised $100M in Series D funding. The round was led by NEA, with participation from SignalFire, Craft Ventures and 9Yards Capital. As part of the investment, Lila Tretikov, Partner and Head of AI Strategy at NEA and former Deputy CTO of Microsoft, will join the Horizon3.ai Board of Directors.

Glean, a Palo Alto, CA-based work AI platform provider, raised $150M in Series F funding, at $7.2B valuation. The round was led by Wellington Management, with participation from new investors including Khosla Ventures, Bicycle Capital, Geodesic Capital, and Archerman Capital, and existing investors including Altimeter, Capital One Ventures, Citi, Coatue, DST Global, General Catalyst, ICONIQ, IVP, Kleiner Perkins, Latitude Capital, Lightspeed Venture Partners, Sapphire Ventures, and Sequoia Capital.

Aethero, a San Francisco, CA-based defense-focused startup building space-grade computers and autonomous satellite platforms, raised $8.4M in funding. The round was led by Kindred Ventures with participation from Neo, Giant Step, O’Shaughnessy Ventures, and Alumni Ventures.

Abacum, a NYC-based business planning software company, raised $60M in Series B funding. The round was led by Scale Venture Partners.

TOOL WORTH EXPLORING

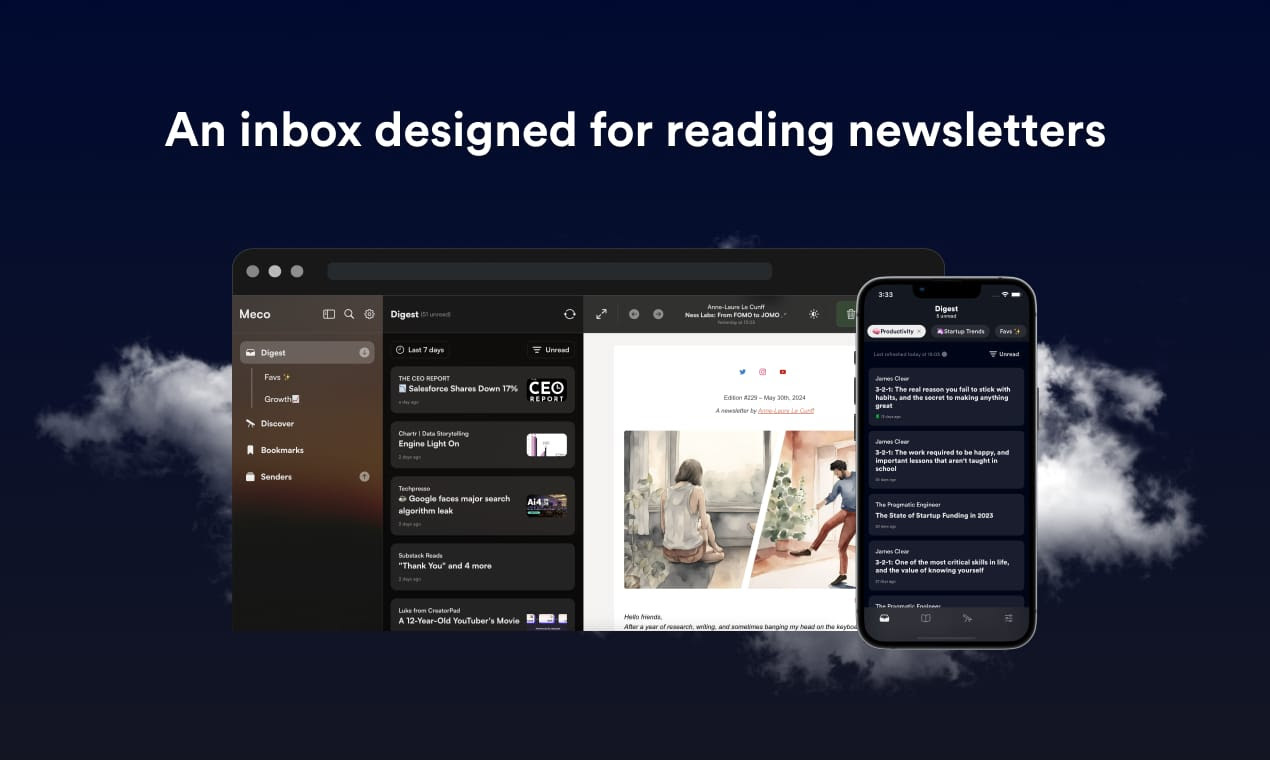

🤝 The best new app for newsletter reading…

Reading newsletters in the inbox is frustrating - it is noisy and easy to lose control of subscriptions. Now with Meco you can enjoy your newsletters in an app built for reading, while giving your inbox space to breathe.

Meco connects to Gmail & Outlook, allowing you to instantly move your newsletters to the app (and clear your inbox.

The experience is packed with features to supercharge your reading including the ability to group newsletters, set smart filters, bookmark your favorites and read in a scrollable feed.

Over 30k readers are enjoying their newsletters (and decluttering their inbox) with Meco - try the app today →

NEW VCs IN THE MARKET

🏦 Venture Capital updates

Collab Capital, an Atlanta-based venture firm co-founded by Jewel Burks Solomon and Barry Givens, has closed a $75 million Fund II to back early-stage startups. The fund includes LPs such as Apple, Goldman Sachs Asset Management, and The Leon Levine Foundation, and will focus on the future of work, healthcare, and infrastructure.

Right Side Capital Management, a San Francisco, CA-based venture capital firm, raised $55m for its sixth VC fund. The firm backs capital efficient tech startups at $1.5M – $4M valuations and $5k – $30k+ MRR.

Geodesic Capital, a San Francisco, CA-based venture capital firm focused on bridging Silicon Valley and Asia through strategic technology investments, held the first close of the Geodesic Alliance Fund, at $250m. Limited Partners include Japanese corporations and Japanese governmental institutions that are aligned with Geodesic’s mission of advancing the U.S.-Japan relationship through technological innovation, while generating returns for investors.

KEY STORIES IN TECH

📜 Latest in tech

OpenAI in talks with Saudi, Indian, and UAE investors for $40B raise:

OpenAI has discussed raising funding from Saudi Arabia’s PIF, India’s Reliance Industries, and UAE-based MGX as part of a $40 billion financing round led by SoftBank.

The Information reports that each investor could contribute at least hundreds of millions, with Coatue and Founders Fund also expected to invest $100 million each.

The funding aims to support OpenAI’s model development and its Stargate infrastructure project, with a separate $17 billion raise expected in 2027.

Apple execs say AI-powered Siri wasn’t “demoware” — just not ready to ship:

Apple executives clarified that the AI-powered Siri shown at WWDC 2024 was real software, but they shifted to a more advanced version after the first failed to meet quality standards.

Craig Federighi confirmed that the new Siri version is still set to launch in 2026, and emphasized Apple’s focus on long-term AI integration rather than rushing a chatbot.

Apple aims to embed intelligence deeply into its operating systems, not create standalone AI chat tools, and wants developers to build on its foundation models.

Disney and Universal sue Midjourney over alleged AI copyright infringement:

Disney and Universal filed a lawsuit against Midjourney, accusing the AI company of using their copyrighted content to train its generative models without permission.

The lawsuit, filed in California, cites examples of AI-generated images resembling characters like Homer Simpson and Darth Vader, and seeks monetary damages and a trial.

This legal action reflects growing tensions between content creators and AI firms over the use of copyrighted materials in training datasets.

Meta unveils V-JEPA 2 to teach AI how the physical world works:

Meta launched V-JEPA 2, a “world model” AI designed to help robots and agents understand and predict real-world physical interactions.

Trained on over 1 million hours of video, the model enables AI to develop common-sense reasoning about objects, actions, and outcomes.

Meta claims V-JEPA 2 is 30 times faster than Nvidia’s Cosmos model, potentially reducing the need for massive robotic training datasets.

Snap will start selling AR glasses next year:

Snap will begin selling its AR glasses, newly named Specs, to the public next year, allowing developers time to polish their AR experiences.

Next year's consumer Specs are said to be noticeably thinner and lighter with a wider field of view, improving on the previous developer-only hardware.

These new Specs will integrate AI from OpenAI and Google for lenses, with Snap relying on its large developer community to build distinct AR experiences.

Meta adds AI video editing tools to compete with Google and startups:

Meta has introduced AI-powered video editing features that let users apply preset styles, effects, and costume changes to 10-second videos.

The tools are now available in the U.S. via the Meta AI app, Meta.ai website, and its CapCut-style app called Edits.

With 50 presets inspired by its Movie Gen models, Meta aims to attract creators by enabling fast, creative edits shareable directly to Instagram and Facebook.

LAST COFFEE SIP

☕Other news

Meta's AI staff flee to rivals despite $2M salaries:

Meta is reportedly losing AI talent, with one VC noting three departures for rivals this week alone, even with over $2 million annual pay packages.

Anthropic draws these AI professionals not just with competitive salaries but with a distinct culture that encourages researcher autonomy, flexible work, and intellectual discourse.

Former Meta staffers now represent 4.3% of new hires at AI labs, part of a larger trend where experienced people leave big tech for these startups.

HIRING ALERT: STARTUPS & VC ROLES

💼 Today’s VC & startup job opportunities

Investment Associate - Schreiber Ventures | USA - Apply Here

Senior Associate - M12 | USA - Apply Here

Venture Capital Manager - Dow Venture Capital | USA - Apply Here

Investment Analyst - Peak Sustainability Venture | India - Apply Here

Investor - Founders Factory | UK - Apply Here

Venture Capital Managing Director - Connecticut Innovation | USA - Apply Here

Investment Trainee - Hashkey Capital | USA - Apply Here

Full-Time Investment Intern - Inflexor Venture | India - Apply Here

Visiting Analyst VC - Identity Venture | Germany | UK - Apply Here

General Partner - Inviox Capital Partner | UK - Apply Here

Investor (AI) - Samsung Next | USA - Apply Here

Startup Scouting Partner - 8state venture | UAE - Aplpy Here

Investor - Griffin Gaming Partner | USA - Apply Here

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs. Don’t miss this. (Access Here)

WHEN YOU’RE READY, HERE’S HOW I CAN HELP:

💁 You might need our help!

Reach 95,000+ Founders & Investors: Partner with our newsletter to reach a highly engaged audience.

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Do you have any news to share about your Startup or VC fund? Please email us.

We’ll be back in your inbox on Tomorrow.