☕ Nvidia hit with $8B revenue loss from H20 chip export ban & Telegram signs $300M xAI deal to integrate Grok.

Tesla’s sales plunge nearly 50% in Europe & Apple to unveil a new gaming app.

Chew gum daily, grow thicker hair.

Apparently, people who chew for 51 minutes a day have denser strands. So yeah, your gum addiction might just be a secret shampoo sponsorship.

Love or hate this intro? Hit reply and tell us why!

📬 What’s in store:

Today’s Picks: Financial model, Khosla's Fund Codex, term sheet guide, 2024 M&A surge, 2700+ US VCs, Figma’s AI evals, nontraditional VC trends. Valuation guide, early-stage model need, data room templates.

Telegram signs $300M xAI deal to integrate Grok

Apple to unveil a new gaming app.

Nvidia hit with $8B revenue loss from H20 chip export ban to China.

DeepSeek updates R1 model and posts it on Hugging Face under MIT license.

Netflix’s Reed Hastings joins Anthropic’s board.

SpaceX Starship rocket explodes in mid-flight.

OpenAI says restructuring makes IPO possible, but timing depends on markets.

Tesla’s sales plunge nearly 50% in Europe as brand crisis deepens.

Sahil Lavingia booted from Musk’s DOGE team after 55 days of frustration and red tape.

VC & Startup Jobs: VC & investors backed startup hiring for remote roles.

⏱️ Read Time: 3 minutes

DAILY PICKS

🗞️ What else is brewing

Excel Template: Early Stage Startup Financial Model For Fundraising.

The Fund Codex: Khosla Ventures.

All-In-One Term Sheet Guide for Founders - terms, preparation, negotiation.

A Banner Year for M&A only Five Months In.

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link).

The Art of Evals: How Figma Put People at the Center of Its AI Product.

The only startup valuation guide you need as a founder.

Do Early-Stage startups need a financial model for fundraising?

Investor data room guide & templates for founders.

Need a pitch deck that gets investor meetings? We’ve opened just 3 slots to help founders craft winning decks—built by experts, reviewed by investors. Don’t leave funding to chance—[schedule a call today →]

INVESTMENT OPPORTUNITY WORTH EXPLORING…

🤝 The Black Eyed Peas Frontman’s $134M Mistake

Grammy winner will.i.am passed on investing $200K in Airbnb. That stake would be worth $134M today. His reason? “Tunnel vision.” Now, another real estate disruptor is taking off – and this time, you can invest.

Founded by Zillow’s Spencer Rascoff, Pacaso has reimagined second-home ownership through co-ownership. And it works, with $110M+ in gross profits and backing from SoftBank. They even reserved the Nasdaq ticker PCSO.

But you can invest today. Don’t let this be your moment of regret.

Invest in Pacaso for $2.80/share before midnight →

*This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

FEATURED YOUR STARTUP

💪 Get your startup in front of over 95,000+ audience

Our newsletter is read by thousands of tech professionals, founders, investors (VCs / Angel Investors) and managers around the world. Get in touch today.

STARTUPS RAISING MILLIONS

💰 Startup funding updates

Grin Therapeutics, Inc., a NYC-based leader in the development of therapies to treat serious neurodevelopmental disorders, closed a $140m Series D financing. This included a $65m strategic equity investment from Angelini Pharma and $75m from existing investor Blackstone Life Sciences.

Context, a Palo Alto, CA – based AI-native office suite, raised $11m in seed funding at a $70m valuation. The round was led by Lux Capital, with participation from Qualcomm Ventures, General Catalyst, and others.

Litehaus, a Portugal-based construction tech startup, raised €1.46M in pre-seed funding to simplify and speed up homebuilding. The round was co-led by Cornerstone VC and Explorer Fund, with participation from Claster Group and Pascal Levy (Long Journey Ventures).

Creatify, a Mountain View, CA-based provider of an AI platform for video advertising, raised $15.5M in Series A funding. The round was led by WndrCo and Kindred Ventures.

Deccan AI, a Palo Alto, CA-based startup which specializes in pristine data for AI model training and evaluations, raised an undisclosed amount in funding. Prosus Ventures made the investment.

Palla, a Miami, FL-based provider of a platform that enables instant cross-border payments for global financial institutions and fintech firms, raised $14.5M in Series A funding. The round was led by Revolution Ventures, with participation from Y Combinator, Ardent, Cowboy Ventures, Dash Fund, Uncommon Capital, Meta Fund, Evolution VC, First Check Ventures, Vitalize, and DeepWork Capital.

ProteinQure, a Toronto, Canada-based biotechnology company developing computational peptide therapeutics, raised $11M in Series A funding. The round was led by Tom Williams of Heron Rock Fund, with participation from Golden Ventures, Kensington Capital, and others.

Conduit, a Boston, MA-based provider of a cross-border payments platform empowered by stablecoins, raised $36M in Series A funding. The round was led by Dragonfly and Altos Ventures, with participation from Sound Ventures, Commerce Ventures, DCG, Circle Ventures, and existing investors Helios Digital Ventures, and Portage Ventures.

Oncade, a San Francisco, CA-based platform for game distribution that turns gaming communities into revenue engines, raised $4M in seed funding. The round was led by a16z CSX, with participation from founders and a network of industry leaders.

Hex, a San Francisco, CA-based provider of an AI-powered workspace for data science and analytics, raised $70M in Series C funding. The round was led by Avra, with participation from a16z, Amplify, Box Group, Redpoint, Sequoia, and Snowflake Ventures.

BlockSpaces, a Tampa, FL-based provider of a Bitcoin-native infrastructure, raised $2M in funding. The round was led by Axiom, with participation from Leadout Capital and other investors including Sand Harbor Capital, Lisa Hough of Eberly Energy Ventures, and Bob Burnett of Barefoot Mining.

CloudZero, a Boston, MA-based company which specializes in proactive cloud cost efficiency, raised $56M in Series C funding. The round was led by BlueCrest Capital Management and Innovius Capital, with participation from Matrix Partners, Threshold Ventures, Underscore VC, G20 Ventures and MongoDB.

Cerby, a San Francisco, CA-based provider of a platform for identity security automation, raised $40M in Series B funding. The round was led by DTCP with participation from existing backers including Okta Ventures, Salesforce Ventures, and Two Sigma Ventures.

Inven, a Helsinki, Finland-based technology company building an AI-native deal sourcing platform, raised $12.75M in Series A funding. The round was led by Ventech, Vendep Capital. Angel investor Risto Siilasmaa, also participated, alongside existing backers Lifeline Ventures and Joint Effects.

Lever Bio, a Turin, Italy-based immuno-oncology company, raised €4M in funding. The round was led by Claris Ventures.

Endra AI, a Stockholm, Sweden-based provider of an AI-powered vertical SaaS platform for building design, raised €3M in Pre-Seed funding. The round was led by Norrsken VC with participation from angel investors Maximilian Viessmann via Vito One, Johan Edenström via Pejoni Ventures, Simon De Château, Oscar, Tom and Edward Höglund and Oljibe Invest.

Spott, a San Francisco, CA-based provider of an operating platform for recruitment agencies, raised $3.2M in funding. The round was led by Base10 Partners, with participation from Y Combinator, Fortino, True Equity and various angels.

Asigna, a smart multisig vault operator for Bitcoin, its metaprotocols and Layer-2s, raised a $3M funding round. The round was led by Hivemind Capital and Tykhe Block Ventures with participation from Sats Ventures, Trust Machines, and various angels. Asigna previously completed a pre-seed round led by Portal Ventures, with support from Bitcoin Frontier Fund.

NEW VCs IN THE MARKET

🏦 Venture Capital updates

Humain, the Saudi state-backed AI company, is planning a $10 billion venture fund named Humain Ventures to invest in startups across the U.S., Europe, and Asia. CEO Tareq Amin confirmed ongoing talks with major firms including Andreessen Horowitz, OpenAI, and xAI. The fund is part of a broader $77B strategy to build 1.9GW of data center capacity and handle 7% of global AI compute by 2030. Deals with Qualcomm, Nvidia, AMD, and Amazon are already in place.

KEY STORIES IN TECH

📜 Latest in tech

Apple to unveil a new gaming app:

Apple has acquired its first gaming studio, RAC7, known for Sneaky Sasquatch, signaling a deeper push into mobile gaming ahead of WWDC.

A new gaming app in iOS 19 is in development to replace Game Center, featuring leaderboards, social tools, and tighter integration with Apple Arcade.

Apple follows Netflix and Microsoft in betting on mobile and cloud gaming as the industry shifts toward more immersive, accessible gameplay experiences.

Nvidia hit with $8B revenue loss from H20 chip export ban to China:

Nvidia reported a $4.5B Q1 charge and missed $2.5B in H20 chip sales due to U.S. export restrictions, with an $8B revenue hit expected in Q2.

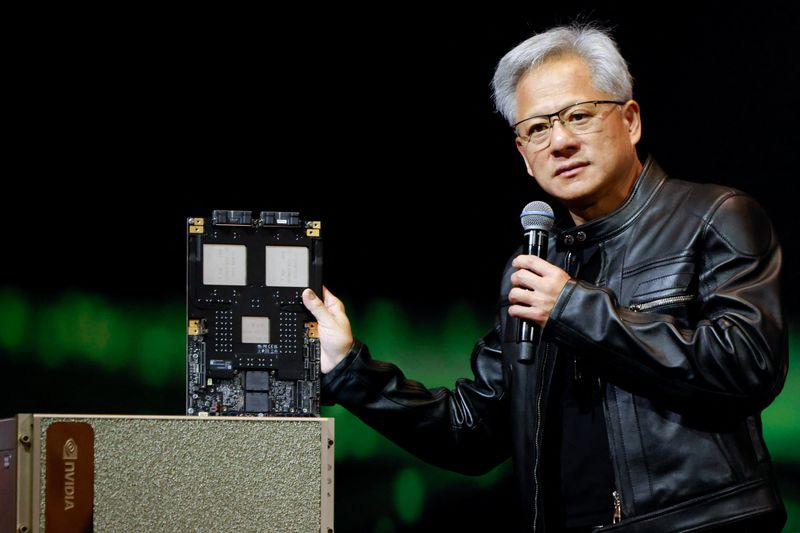

CEO Jensen Huang criticized the Trump administration's ban, saying it effectively shuts Nvidia out of China’s $50B AI market, one of the world’s largest.

While the Biden-era AI Diffusion Rule was scrapped, Nvidia warns that ongoing restrictions only boost Chinese chipmakers and hurt U.S. leadership.

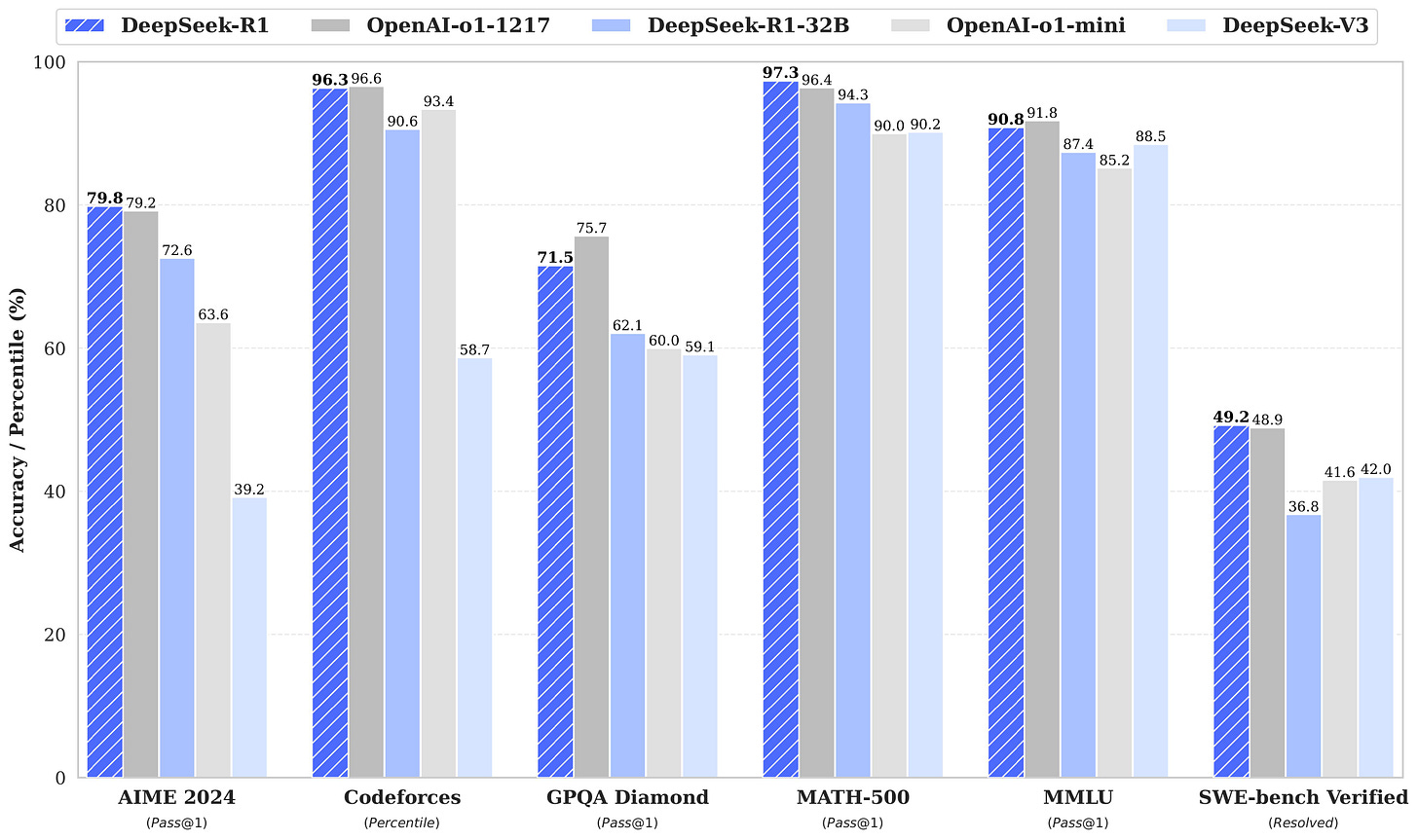

DeepSeek updates R1 model and posts it on Hugging Face under MIT license :

Chinese AI startup DeepSeek released an updated version of its R1 reasoning model on Hugging Face with a permissive MIT license for commercial use.

The model, a minor upgrade per DeepSeek’s WeChat announcement, is massive at 685 billion parameters — too large for most consumer hardware.

R1 previously challenged OpenAI's dominance, raising concerns among U.S. regulators over potential national security implications.

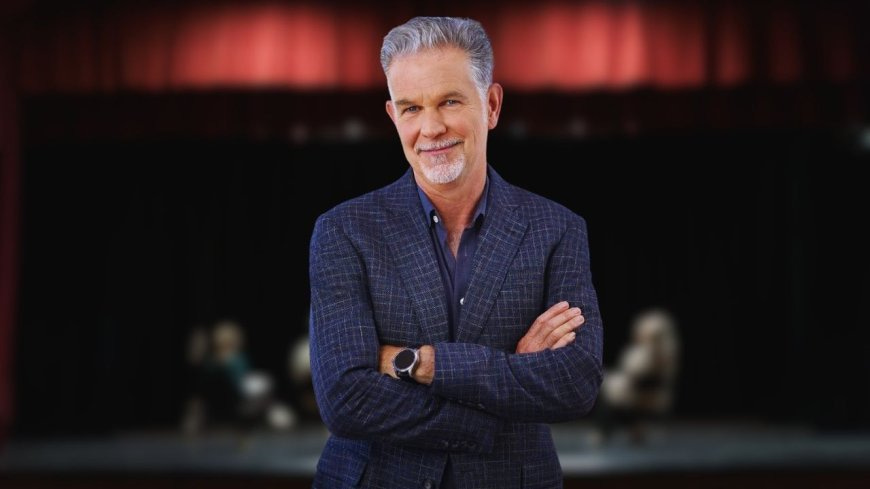

Netflix’s Reed Hastings joins Anthropic’s board :

Anthropic has appointed Netflix co-founder Reed Hastings to its board of directors, adding major tech leadership to its growing AI ambitions.

The appointment was made by Anthropic’s Long-Term Benefit Trust, which guides the company’s mission to develop AI that benefits humanity.

Hastings brings experience from serving on boards of Netflix, Microsoft, Bloomberg, and Meta, and joins Anthropic’s co-founders and other leaders.

Musk’s xAI to pay Telegram $300M to distribute Grok chatbot:

Elon Musk’s xAI is partnering with Telegram to distribute its chatbot Grok across the messaging app for one year.

The deal includes a $300 million cash and equity payment to Telegram and gives the app 50% of revenue from Grok subscriptions purchased through it.

Grok will be deeply integrated into Telegram features like chat summaries, writing suggestions, and search-based queries.

SpaceX Starship rocket explodes in mid-flight:

SpaceX's Starship upper stage reached space intact but subsequently spun out of control and burned up during atmospheric re-entry on its ninth flight test.

A leak in the fuel tank systems caused the Starship upper stage to lose main tank pressure and attitude control, leading to its fiery disintegration.

The mission also saw Starship’s first stage booster explode before it could complete a test landing burn, separate from the upper stage’s later failure.

OpenAI says restructuring makes IPO possible, but timing depends on markets :

OpenAI CFO Sarah Friar says converting to a public benefit corporation makes the company "IPO-able," though no listing is currently planned.

OpenAI may need up to $500 billion in capital to support 10 gigawatts of data capacity, highlighting its massive growth ambitions.

AI search is a top priority, and the focus is on building breakthrough products rather than shaving small efficiency gains.

Tesla’s sales plunge nearly 50% in Europe as brand crisis deepens :

Tesla’s European sales fell 49% year-over-year in April despite the launch of a refreshed Model Y, signaling weakening brand strength.

EV demand in Europe is growing overall, but Tesla is losing share to local and Chinese rivals, amid Elon Musk’s controversial political involvement.

Public perception of Musk has declined, dragging Tesla’s reputation down from top-tier to near-bottom in brand rankings.

LAST COFFEE SIP

☕Other news

Sahil Lavingia booted from Musk’s DOGE team after 55 days of frustration and red tape :

Gumroad founder Sahil Lavingia joined DOGE as a volunteer engineer for the VA, aiming to cut inefficiencies but quickly ran into government constraints and bureaucracy.

He described DOGE as a powerless advisory body used as a scapegoat by agency heads and was surprised to find that the VA, while slow, mostly worked as intended.

Lavingia was dismissed without warning after talking to Fast Company, capping a brief stint where he built tools but wasn’t allowed to ship anything meaningful.

HIRING ALERT: STARTUPS & VC ROLES

💼 Today’s VC & startup job opportunities

Investment Manager - Techstar | USA - Apply Here

Chief of Staff & Head of Administrative Operations - Beyond Alpha Venture | USA - Apply Here

Finance Associate - Good Capital | India - Apply Here

Venture Partner - 007 Venture Partner | USA - Apply Here

Venture Partner - Taise Venture | USA - Apply Here

Partner 36 - a16z | USA - Apply Here

Venture Partner - Moivre Venture | UK - Apply Here

Associate - Rev1 Venture | USA - Apply Here

Investment Analyst - Lumikai Fund | India - Apply Here

Investor - Griffin Gaming Partner | USA - Apply Here

Associate - Omerse Venture | USA - Apply Here

Investment Analyst - In Q Tel | Singapore - Apply Here

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs. Don’t miss this. (Access Here)

WHEN YOU’RE READY, HERE’S HOW I CAN HELP:

💁 You might need our help!

Reach 92,500+ Founders & Investors: Partner with our newsletter to reach a highly engaged audience.

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Do you have any news to share about your Startup or VC fund? Please email us.

We’ll be back in your inbox on Tomorrow.