☕ Google's new AI can browse websites and apps for you & Nvidia invests $2 billion in Elon Musk’s xAI.

Neuralink user controls a robot arm with brain chip’ & SoftBank makes a $5.4 billion bet on AI robots.

📬 What’s in store:

Today’s Picks: B2B SaaS PMF benchmarks, investor Q&A, LP shift, 40 pitch decks, Elad Gil AI markets, legal docs, a16z AI tools.

Google’s new AI can browse websites and apps for you.

Even after Stargate, Oracle, Nvidia, and AMD, OpenAI has more big deals coming soon.

Nvidia invests $2 billion in Elon Musk’s xAI.

Google launches extensions system for its command-line coding tool.

Neuralink user controls a robot arm with brain chip’.

SoftBank makes a $5.4 billion bet on AI robots.

Sora’s downloads in its first week was nearly as big as ChatGPT’s launch.

Musk’s X settles ex-Twitter executives’ $128 million severance lawsuit.

VC & Startup Jobs: VC & investors backed startup hiring for remote roles.

FROM OUR PARTNER - 1PASSWORD

🤝 Outsmart cybercriminals without breaking your budget

Bad actors see SMBs as easier targets, but the consequences they face from cyberattacks are just as severe, including financial loss, downtime, and lasting reputational damage.

Check out 1Password’s on-demand webinar for a discussion with Sebastian Cevallos, Senior Product Marketing Manager, and Paul Hanrahan, SMB Solutions Engineer.

Together, they break down how small businesses can keep cybersecurity and credential management simple, achievable, and affordable.

PARTNERSHIP WITH US

💪 Get your startup in front of over 95,000+ audience.

Our newsletter is read by thousands of tech professionals, founders, investors (VCs / Angel Investors) and managers around the world. Get in touch today.

DAILY PICKS

🗞️ What else is brewing

B2B SaaS benchmarks VCs use to spot product-market fit.

What investors ask and how to answer : A practical Q&A prep kit for founders.

The quiet shift in VC: LPs moving money from giants to nimble funds.

40 real startup pitch decks that raised $350M+ (Including leading startups decks).

Elad Gil : Six AI markets are now locked — here’s your next move..

Startup Legal Document Pack – Essential Legal Docs for Founders.

AI tools used by a16z partner Olivia Moore.

Investor Data Room Guide & Templates for Founders.

The 9-step framework for successful monetisation.

The 60-second pitch formula that gets investors to say “Yes”.

Excel Template: Early Stage Startup Financial Model For Fundraising

What founders can learn from Zuck’s “superintelligence” memo.

STARTUPS RAISING MILLIONS

💰 Startup funding updates

HiOctave, a San Francisco, CA-based AI software company helping small and mid‑sized businesses (SMBs) automate and personalize customer experiences, announced its launch and $15M in funding. The round was led by Vinod Khosla and Khosla Ventures. Additional investors and shareholders included Celesta Capital, Anthology Fund, operated jointly by Anthropic and Menlo Ventures, and Carya Venture Partners.

QuoteWell, an Austin, TX-based tech-driven wholesale insurance brokerage, raised additional $12M in funding. The round was led by New Enterprise Associates, with participation from new investors Brand Foundry Ventures, ClockTower Ventures and existing investors Goldcrest Capital and Floating Point among others.

Reo.Dev, a San Francisco, Calif. — based intent platform built specifically for developer-first software companies, raised $4m in seed funding. The round was led by Heavybit, with participation from India Quotient and Foster Ventures.

AiPrise, a San Francisco, CA-based company building the operating system for global compliance, raised $12.5M in Series A funding. The round was led by Headline, with participation from Y Combinator, SixThirty Ventures, Correlation Ventures, and a select group of strategic angels.

Arthrosi Therapeutics, a San Diego, CA-based late-stage biotechnology company developing URAT1 inhibitors, raised $153M in Series E funding. The round was led by Prime Eight Capital Limited and with participation from CR Biotech, HighLight Capital, HM Venture Partners, ReliantTech Limited, and existing shareholders.

Lucio, a Bengaluru, India-based provider of an AI-native legal workspace built by lawyers, raised $5M in funding. The round was led by DeVC and HNIs Ashish Kacholia and Lashit Sanghvi.

Appy.AI, a Denver, CO-based provider of an AI business creation platform, raised $5M in Seed funding. The round was led by Dan Scholnick at Four Rivers and Founder Collective.

Nava Benefits, a NYC-based tech-enabled benefits brokerage empowering HR teams with technology and support, raised $30M in Series C funding. The round was led by Thrive Capital with participation from Glynn Capital, GV, Quiet Capital, Gaingels, People Tech Partners, Fenwick, Alumni Ventures, and Pascal Ventures.

Dragonfly, a London, UK-based provider of a software discovery platform, raised £2.6M in Pre-Seed funding. The round was led by Episode 1, joined by Dreamcraft and Portfolio Ventures, with angels including QuantumBlack founder and CTO Sam Bourton, and Bolt founder and CEO Markus Villig.

Zingage, a NYC-based provider of an AI care delivery platform for home care, raised $12.5M in Seed funding. The round was led by Bessemer Venture Partners, alongside TQ Ventures, South Park Commons, WndrCo, and executives from Ramp.

Increase Alpha, a Washington, DC-based fintech startup using predictive artificial intelligence, raised US$3.5M in seed funding. The round was led by Bartt Kellermann, CEO of Battle of the Quants.

Splash Sports, a Denver, CO-based skill-based social sports gaming company, raised $14.5M in Series B funding. The round was led by Dream Ventures with participation from EP Golf Ventures, Boston Seed, Velvet Sea Ventures, Green Wave Ventures, and Evolution Partners.

Base Power, an Austin, TX-based energy company, raised $1 Billion in Series C funding. The round was led by Addition with participation from Trust Ventures, Valor Equity Partners, Thrive Capital, Lightspeed, Andreessen Horowitz, Altimeter, StepStone, Elad Gil, 137 Ventures, Terrain, and Waybury. New major investors included Ribbit, CapitalG, Spark, BOND, Lowercarbon, Avenir, Glade Brook, Positive Sum, and 1789.

Anthea, a Bermuda-based crypto life insurance company, raised US$22M in Series A funding. The round was led by Yunfeng Financial Group Limited with participation from others investors.

Glue, a San Francisco, CA-based provider of a platform for agentic team chat, raised $20M in funding. The round was led by Abstract Ventures, with participation from Chapter One, Goldcrest Capital, and Craft Ventures.

Enurgen, an Ottawa, Ontario, Canada-based developer of the solar industry’s yield performance model, raised $4.1M USD in Seed funding. The round was led by Business Development Bank of Canada (BDC), Brightspark, and Diagram, with participation from MaRS IAF.

Invigilator, a South African-founded remote assessment platform provider, raised $11M in international equity funding. The round was led by Kaltroco.

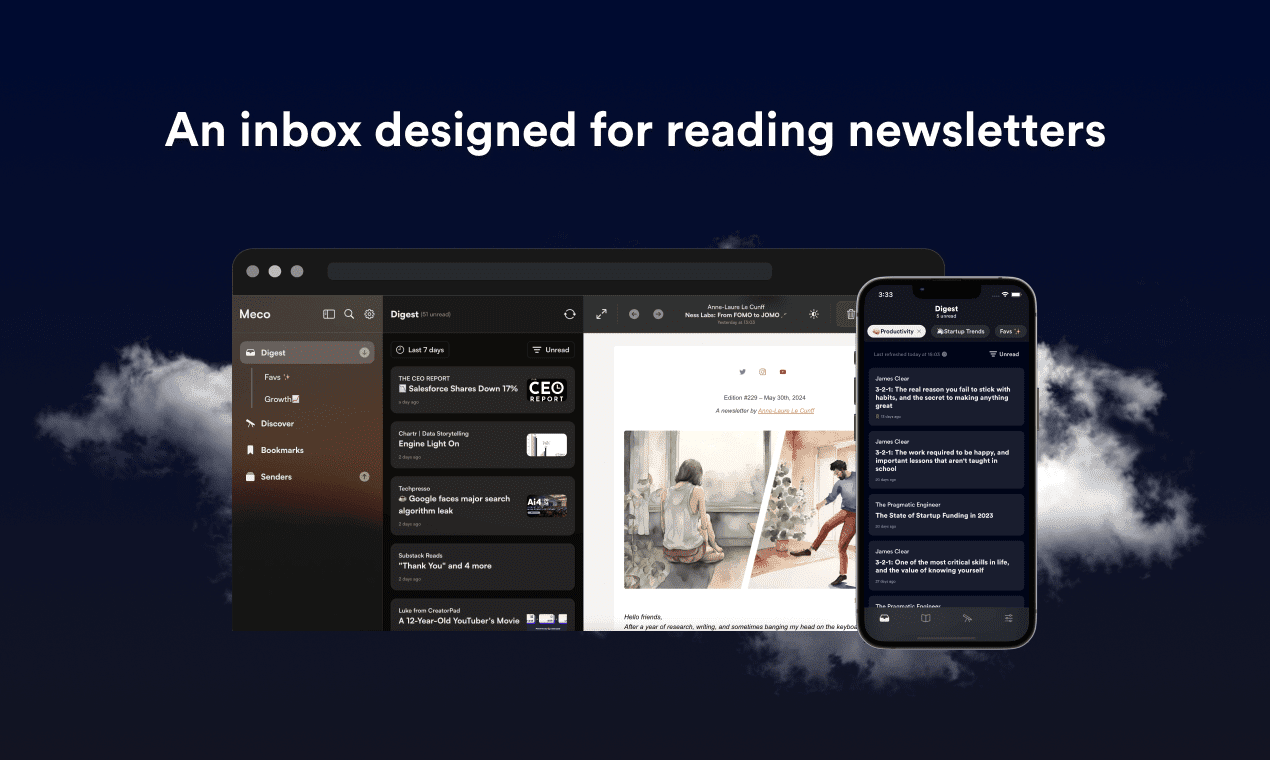

FROM OUR PARTNER - MECO

The best new app for newsletter reading

Reading newsletters in the inbox is frustrating - it is noisy and easy to lose control of subscriptions. Now with Meco you can enjoy your newsletters in an app built for reading, while giving your inbox space to breathe.

Meco connects to Gmail & Outlook, allowing you to instantly move your newsletters to the app (and clear your inbox)

The experience is packed with features to supercharge your reading including the ability to group newsletters, set smart filters, bookmark your favorites and read in a scrollable feed.

You can try the experience for free and available on iOS, Android and web (desktop)

Over 30k readers are enjoying their newsletters (and decluttering their inbox) with Meco - try the app today!

NEW VCs IN THE MARKET

🏦 Venture Capital updates

Boulder, Colo.-based insurance investor Markd raised an additional $500m in commitments for its debut fund. Through the end of the year, Markd, in consultation with existing fund investors, may consider even further increasing the overall fund size to accept additional commitments from insurance companies. Led by Parker Beauchamp, the fund will continue Markd’s exclusive focus on the insurance industry’s future.

Sugar Free Capital, a NYC-based venture capital firm, has launched with its $32m inaugural fund. Rhe fund raised within just six months with commitments from institutional investors, and the family offices of technical luminaries, including executives from Nvidia, Citadel, Jane Street, Renaissance Technologies, Crusoe and The Boston Consulting Group.

KEY STORIES IN TECH

📜 Latest in tech

Google’s new AI can browse websites and apps for you

Google Deepmind released its Gemini 2.5 Computer Use model, which is designed to let AI agents operate web browsers and mobile interfaces by directly interacting with graphical elements.

The system functions in a continuous loop by looking at a screenshot, generating UI actions like clicking or typing, and then receiving a new screenshot to repeat the process.

To prevent misuse, a per-step safety service reviews every proposed action, while developers can also require user confirmation or block specific high-stakes actions from being performed by the AI.

Even after Stargate, Oracle, Nvidia, and AMD, OpenAI has more big deals coming soon:

Sam Altman confirmed on the a16z Podcast that OpenAI plans to announce more large-scale infrastructure and financing deals in the coming months.

This comes as Nvidia CEO Jensen Huang admitted he was unaware of OpenAI’s multibillion-dollar AMD partnership, which mirrors Nvidia’s own $100B investment — both deals structured around stock-linked financing for AI chips.

OpenAI has already commissioned 10 GW of U.S. data centers under its $500B Stargate deal with Oracle and SoftBank, plus additional 10 GW with Nvidia and 6 GW with AMD, signaling over $1T in total commitments as it prepares to become a self-hosted hyperscaler.

Nvidia invests $2 billion in Elon Musk’s xAI

Nvidia is investing roughly $2 billion in equity in Elon Musk’s xAI as part of a larger financing round that includes backers like Apollo Global Management and Valor Capital.

The arrangement uses a special-purpose vehicle to buy Nvidia chips and lease them back to xAI for five years, a setup that helps the AI firm avoid adding corporate debt.

These funds are for the Colossus 2 data-center buildout, though Musk denies raising capital, a claim possibly justified by the unconventional structure that avoids a direct cash injection for xAI.

Google launches extensions system for its command-line coding tool

Google introduced Gemini CLI Extensions, allowing third-party developers to integrate directly with its Gemini command-line AI system.

Unlike OpenAI’s curated app system, Gemini CLI extensions are open-source and hosted on GitHub, where anyone can publish and install them manually.

The launch includes integrations with Figma and Stripe, marking Google’s push to make Gemini CLI a flexible, developer-first extensibility platform.

Neuralink user controls a robot arm with brain chip'

Nick Wray, a patient with ALS, demonstrated controlling a robot arm with his Neuralink brain chip by directing the device to pick up a cup and bring it to his mouth.

Using the implant, Wray performed daily tasks like putting on a hat, microwaving his own food, opening the fridge, and even slowly driving his wheelchair with the robotic limb.

Neuralink’s device works by converting brain signals into Bluetooth-based remote commands, giving the user direct control to manipulate the movements of the separate robot arm.

SoftBank makes a $5.4 billion bet on AI robots

Japanese group SoftBank is making a major return to the bot business by acquiring ABB’s robotics division for $5.4 billion, pending the green light from government regulators.

Founder Masayoshi Son calls this new frontier “Physical AI,” framing it as a key part of the company’s plan to develop a form of super intelligent artificial intelligence.

Robots are one of four strategic investment areas for SoftBank, which is also pouring huge amounts of money into chips, data centers, and new energy sources to dominate the industry.

Sora’s downloads in its first week was nearly as big as ChatGPT’s launch

OpenAI’s video-generation app Sora hit 627,000 iOS downloads in its first week, surpassing ChatGPT’s 606,000 iOS installs during its debut week, per Appfigures data.

Adjusted for geography — since ChatGPT launched only in the U.S. and Sora also in Canada — Sora’s U.S.-only performance would still be 96% of ChatGPT’s.

The invite-only app reached No. 1 on the U.S. App Store within days, with daily downloads peaking at 107,800, signaling massive early traction for OpenAI’s newest consumer product.

LAST COFFEE SIP

☕ Other news

Musk’s X settles ex-Twitter executives’ $128 million severance lawsuit

Elon Musk’s X Corp. has settled a lawsuit filed by former Twitter executives — Parag Agrawal, Ned Segal, Vijaya Gadde, and Sean Edgett — who claimed they were owed $128 million in severance pay after being fired post-acquisition.

The settlement terms were not disclosed, but a San Francisco federal judge delayed proceedings to allow finalization.

This follows X’s earlier $500 million settlement with laid-off employees and adds to the growing list of legal disputes stemming from Musk’s $44 billion Twitter takeover and subsequent mass firings.

HIRING ALERT: STARTUPS & VC ROLES

💼 Today’s VC & startup job opportunities

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs. Don’t miss this. (Access Here)

Analyst - Tower Research Venture | USA - Apply Here

Research Analyst - Positive Sum | USA - Apply Here

Fund Operations Associate - TNB Aura | Singapore - Apply Here

VP, Ventures - Synchroni Venture | USA - Apply Here

Research Intern, Crypto - a16z | USA - Apply Here

Senior VC Analyst - Working Capital Fund | USA - Apply Here

2026 Venture Capital Summer Analyst - Stepstone Group | USA - Apply Here

AI Venture Analyst Intern - Untaped Venture | USA - Apply Here

Investor Relations Manager - Beco Capital | UK - Apply Here

WHEN YOU’RE READY, HERE’S HOW I CAN HELP:

💁 You might need our help!

Reach 95,000+ Founders & Investors: Partner with our newsletter to reach a highly engaged audience.

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Do you have any news to share about your Startup or VC fund? Please email us.

We’ll be back in your inbox on Tomorrow.