☕ Apple to rename all operating systems, Hugging Face unveils two open source humanoid robots & Musk reportedly tried to block OpenAI UAE AI deal.

App Store hit $406B in sales in 2024 & Elon Musk quits DOGE, blasts Donald Trump's bill.

Your startup’s first investor might already be in your inbox.

You just need the right email, the right pitch, and the right person to send it to.

We’ve curated battle-tested resources used by leading VCs and breakout founders—email templates, pitch decks, financial models, cap tables, and 10,000+ investor contacts across 6 continents. Access Here..

📬 What’s in store:

Today’s Picks: Sam Altman on fundraising, AI UX shift, dorm-room to $1M product, AI hallucinations, agent economy, 2025 IPOs, VC fears, SaaS outlook, founder traps, Valuation guide, AI 100, financial model need, AI labor premium.

Apple to rename all operating systems by year starting with iOS 26.

Hugging Face unveils two open source humanoid robots.

Delaware attorney general hires bank to assess OpenAI’s restructuring.

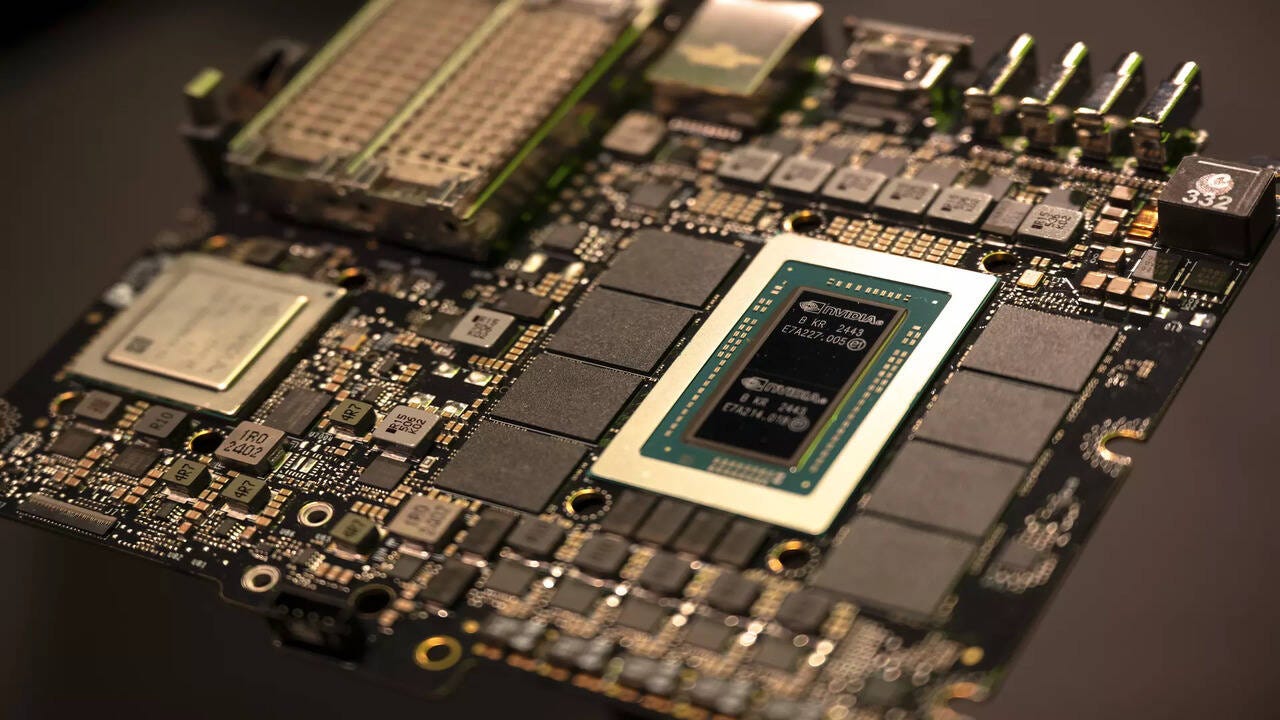

Nvidia, AMD to launch China-specific AI chips under U.S. export rules.

The New York Times and Amazon ink AI licensing deal.

Meta faces breakup threat as FTC monopoly trial ends.

Musk reportedly tried to block OpenAI UAE AI deal.

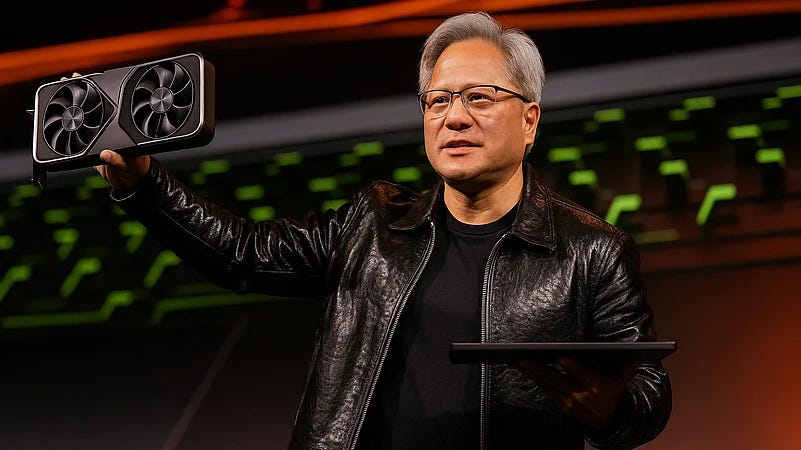

Nvidia CEO warns that Chinese AI rivals are now ‘formidable’. Apple’s U.S.

App Store hit $406B in sales in 2024, nearly tripling since 2019.

Elon Musk quits DOGE, blasts Donald Trump's bill.

VC & Startup Jobs: VC & investors backed startup hiring for remote roles.

⏱️ Read Time: 3 minutes

DAILY PICKS

🗞️ What else is brewing

Sam Altman's Guide to Startup Fundraising: What Really Works.

Making a Million-Dollar Product From a Dorm Room.

AI Hallucinations Are Getting Worse.

Building the agent economy: How cloud leaders are shaping AI’s next frontier.

8 venture-backed IPO candidates to watch in 2025.

State of VC-backed SaaS Startups in 2025.

Symptoms vs. problems: the trap every founder must avoid.

The only startup valuation guide you need as a founder.

Building the agent economy: How cloud leaders are shaping AI’s next frontier.

Book of Scouting Reports: 2025’s AI 100.

Do Early-Stage startups need a financial model for fundraising?

When Will We Pay a Premium for AI Labor? By Tomasz Tunguz.

Investor data room guide & templates for founders.

Need a pitch deck that gets investor meetings? We’ve opened just 3 slots to help founders craft winning decks—built by experts, reviewed by investors. Don’t leave funding to chance—[schedule a call today →]

CURATED RESOURCES FOR FOUNDERS…

🤝 The Ultimate Resource Hub for Founders…

Your startup’s first investor might already be in your inbox. You just need the right pitch, the right email—and the right list of who to send it to.

We’ve curated the exact resources used by top VCs and breakout founders to raise millions:

Global investor contact databases (US, Europe, India, Africa, Latin America, France, Australia & more)

Pitch deck templates & storytelling guides

Early-stage startup financial models & projections (including SaaS models)

Cap table builder and investor CRM tracker

Legal doc packs, founder agreements, valuation templates, and term sheet guides

Competitor analysis frameworks & investor update templates

VC interview prep guides & data room checklists

Everything you need to pitch smarter, raise faster, and run your startup with confidence.

FEATURED YOUR STARTUP

💪 Get your startup in front of over 95,000+ audience

Our newsletter is read by thousands of tech professionals, founders, investors (VCs / Angel Investors) and managers around the world. Get in touch today.

STARTUPS RAISING MILLIONS

💰 Startup funding updates

Grammarly, a San Francisco-based AI writing assistant company, secured $1 billion in nondilutive funding from General Catalyst’s Customer Value Fund.

Naoris Protocol, a Wilmington, DE-based quantum-resistant blockchain and cybersecurity mesh architecture company, raised $3M in funding. The round was led by Mason Labs, with participation from Frekaz Group, Level One Robotics and Tradecraft Capital.

David, a NYC-based brand that designs tools to increase muscle and decrease fat, raised $75M in Series A funding. The round was led by Greenoaks with the participation of Valor Equity Partners.

Empathy, a NYC-based lost support and legacy planning technology company, raised $72M in Series C funding. The round was led by Adams Street Partners with participation from General Catalyst, Index Ventures, Entrée Capital, Brewer Lane Ventures, SemperVirens, Latitude, and LionTree, Aflac Ventures, Allianz Life Ventures, Citi Impact Fund, Munich Re, MetLife, New York Life, Securian, and TIAA Ventures.

DreamPark, a San Francisco, CA-based creator of a downloadable mixed reality (XR) theme park, raised $1.1M in seed funding. The round was led by Long Journey Ventures, with participation from Founders Inc.

Acclaro Medical, a Smithfield, RI-based medical technology company focused on developing solutions for patient care and medical practices, raised $23M in Series B funding. The round was led by Accelmed Partners with participation from existing investor 3E Bioventures Capital.

FarmQA, a Fargo, ND-based provider of a digital agronomy platform, raised $4M in Seed funding. The round was led by gener8tor 1889, with participation from O’Leary Ventures, Wonder Fund North Dakota, and Badlands Capital.

ClickHouse, Inc., a San Francisco, CA-based leader in real-time analytics, data warehousing, observability, and AI/ML, raised $350m in Series C financing. The round was led by Khosla Ventures, with participation from new investors BOND, IVP, Battery Ventures, and Bessemer Venture Partners, as well as existing investors including Index Ventures, Lightspeed, GIC, Benchmark, Coatue, FirstMark, and Nebius.

Vivodyne, a San Francisco, CA-based company developing drug testing on lab-grown 3D human tissues, raised $40M in Series A funding. The round was led by Khosla Ventures, with participation from new investors Lingotto Investment Management, Helena Capital, Fortius Ventures, and existing investors Kairos Ventures, CS Ventures, Bison Ventures, and MBX Capital.

LovOn, a Wilmington, DE-based provider of an AI-powered bonding platform for couples, raised $850K in Pre-Seed funding. The round was led by Pre-Seed to Succeed, an investment program backed by AltaIR Capital, Yellow Rocks, Smart Partnership Capital, and I2BF Ventures, with participation from HEARTFELT and 13 business angels.

Buildots, a Tel Aviv, Israel-based leader in AI-powered construction management, closed a $45m Series D funding round. The round, which brought total funding to $166m, was led by Qumra Capital with participation from OG Venture Partners, TLV Partners, Poalim Equity, Future Energy Ventures, and Viola Growth.

CalcTree, a Sydney, Australia-based provider of an engineering calculation platform, raised €2.3M in Pre-Seed funding. The round was led by Foundamental. Other investors included Kungari, Suffolk Technologies, and Antler VC, as well as Autodesk & Bentley employees.

Wander, an Austin, TX-based company combining luxury hotel experiences with the comfort of a private vacation home, raised $50M in Series B Funding. The round was led by QED Investors and Fifth Wall with participation from Redpoint Ventures, Uncork, Starwood, and Breyer Capital and many other returning and new investors.

Atomic Canyon, a San Louis Obispo, CA-based developer of the Artificial Intelligence (AI)-powered search and generative AI tools for the nuclear power industry, raised $7M in funding. The round was led by Elevate Future Fund from Energy Impact Partners (EIP), with participation from Commonweal Ventures, Plug and Play Ventures, Wischoff Ventures, Tower Research Ventures, and previous angel investors.

Velocity, a London, UK-based financial infrastructure startup, raised $10m in pre-seed funding. The round was led by Activant Capital with participation from Fuel Ventures, Triton Capital, Fabric Ventures, Commerce Ventures, and Preface Ventures.

Rillet, a NYC-based provider of an AI-native ERP (enterprise resource planning) platform, raised $25M in Series A funding. The round was led by Sequoia Capital.

Applied Computing, a London, UK-based provider of a software platform bringing intelligence to the Oil, Gas, and Petrochemical Industries, raised £9m in seed funding. The round was led by Repeat VC and Stride.VC.

Alrik, a Stockholm, Sweden-based construction logistics startup, raised $7m in total funding. The latest round of undisclosed amount was led by People Ventures, with participation from current backer Pi Labs.

Kyron.bio, a Paris, France-based glycan engineering startup, raised €5.5m in funding. The round was led by HCVC with participaiton from Verve Ventures, Entrepreneur First, and Saras Capital.

Sequence, an Israeli founded, NYC-based fintech startup, raised $7.5M in funding. The round, which brought total funding to $14.5m, was led by Aleph and Emerge with participation from ICON and Yasmin Lukatz.

NEW VCs IN THE MARKET

🏦 Venture Capital updates

Zeal Capital Partners, a Washington, D.C.–based venture firm, has closed Fund II with $82 million to back early-stage companies in fintech, healthcare, and the future of work. Investors include Citi Impact Fund, M&T Bank, Wells Fargo, and Spelman College. Zeal plans to invest in at least 25 companies with check sizes between $1M–$2.3M, and has already backed startups like Seven Starling and Debbie. Over 80% of Fund I’s LPs returned, underscoring confidence in Zeal’s thesis-driven approach despite a tough fundraising climate.

KEY STORIES IN TECH

📜 Latest in tech

Apple to rename all operating systems by year starting with iOS 26:

Apple will shift to naming OS versions by year, starting with iOS 26, replacing the current sequential system.

The rebrand will apply across products: iPadOS 26, macOS 26, watchOS 26, tvOS 26, and visionOS 26.

The change will be unveiled at WWDC on June 9, alongside new UIs, AirPods updates, and major AI feature rollouts.

Hugging Face unveils two open source humanoid robots:

Hugging Face introduced two open source humanoid robots: HopeJR, a full-size robot with 66 degrees of freedom, and Reachy Mini, a desktop AI testing bot.

HopeJR is expected to cost ~$3,000 and Reachy Mini around $250–$300, with shipments beginning later this year.

The launch follows Hugging Face’s acquisition of Pollen Robotics and continues its push into democratized, transparent robotics development.

Delaware attorney general hires bank to assess OpenAI’s restructuring:

Delaware’s AG is hiring an investment bank to independently evaluate OpenAI’s nonprofit equity stake in its restructuring plan.

The move could delay OpenAI’s conversion into a public benefit corporation and its path toward IPO.

Elon Musk’s $97.4B takeover bid, though rejected, may have inflated the nonprofit’s valuation, complicating the restructuring.

Nvidia, AMD to launch China-specific AI chips under U.S. export rules:

Nvidia and AMD will release new AI chips in China that comply with U.S. export restrictions, Nvidia’s is codenamed “B20,” and AMD’s is the Radeon AI PRO R9700.

The chips are expected to launch in July, with Nvidia’s budget Blackwell-based GPU priced at $6,500–$8,000.

Nvidia forecast an $8B Q2 revenue hit after licensing issues halted $7B worth of H20 chip sales in Q1

The New York Times and Amazon ink AI licensing deal:

The New York Times has agreed to license its editorial content to Amazon for use in training AI platforms and enhancing products like Alexa.

The deal includes access to news articles, NYT Cooking content, and The Athletic, with links directing users to full NYT experiences when appropriate.

This marks Amazon’s first generative AI licensing agreement and the Times' first such deal, following its lawsuit against OpenAI and Microsoft for unauthorized content use.

Meta faces breakup threat as FTC monopoly trial ends:

The Federal Trade Commission's monopoly trial against Meta has ended, with the agency pushing for a breakup to end its alleged control in "personal social networking services".

Judge James Boasberg denied Meta's attempt to dismiss the case mid-trial and will take months to decide if the Instagram and WhatsApp acquisitions violated antitrust law.

Meta and the FTC will file follow-up briefings over summer, after which Judge Boasberg aims to rule "expeditiously" on the purchases, potentially before this year concludes.

Musk reportedly tried to block OpenAI UAE AI deal:

Elon Musk reportedly used President Trump's name as leverage with G42 executives to block OpenAI's AI data center deal in Abu Dhabi, WSJ said.

Musk warned G42 executives their Stargate UAE project would not get White House approval unless his own AI startup, xAI, was included in the partnership.

Despite Musk’s reported objections and his push for xAI, the Trump administration proceeded with and officially announced OpenAI’s data center agreement with G42.

Nvidia CEO warns that Chinese AI rivals are now ‘formidable’:

Nvidia CEO Jensen Huang stated Chinese competitors evolved, making firms like Huawei quite formidable after US restrictions on AI chip exports affected sales of H20 AI chips.

Huang highlighted these rivals are rapidly increasing their capabilities and production volume, benefiting from the void left by American companies in that key region.

Despite US policy aiming to limit access, Huang emphasized local firms find alternatives, underscoring the country's significant AI researcher population and importance.

LAST COFFEE SIP

☕Other news

Apple’s U.S. App Store hit $406B in sales in 2024, nearly tripling since 2019:

Apple says the U.S. App Store ecosystem generated $406B in developer billings and sales in 2024, up from $142B in 2019.

90% of these billings occurred without Apple taking a commission, highlighting the platform’s value for non-digital goods and ads.

Despite the growth, Apple faces legal pressure to allow external payments, following a ruling stemming from Epic Games’ lawsuit.

Elon Musk quits DOGE, blasts Donald Trump's bill:

Elon Musk has stepped down from his controversial role leading the Trump administration’s “Department of Government Efficiency” (Doge), ending a term marked by mass layoffs, gutted services, and incomplete modernization efforts.

Doge’s cuts severely impacted critical agencies including USAID, NOAA, and the Department of Veterans Affairs, dismantling programs like global HIV aid and natural disaster forecasting, with no clear plan for rebuilding.

Although Musk is returning to his companies, many of his allies remain embedded in government positions with significant power, raising concerns about long-term institutional damage and data misuse.

HIRING ALERT: STARTUPS & VC ROLES

💼 Today’s VC & startup job opportunities

Managing Director - Generator Accelerator | USA - Apply Here

Investment Manager - Techstar | USA - Apply Here

Venture Partner - 007 Venture Partner | USA - Apply Here

Associate - Rev1 Venture | USA - Apply Here

Investor - Griffin Gaming Partner | USA - Apply Here

Associate - Omerse Venture | USA - Apply Here

Investor Relationship Associate - Bauken Capital | USA - Apply Here

Venture Capital Junior Analyst - Stepstone Group | USA - Apply Here

Venture Capital Managing Director - Connecticut Innovation | USA - Apply Here

Vice President Finance - Spring Tide Venture | USA - Apply Here

Investment Trainee - Hashkey Capital | USA - Apply Here

Full-Time Investment Intern - Inflexor Venture | India - Apply Here

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs. Don’t miss this. (Access Here)

WHEN YOU’RE READY, HERE’S HOW I CAN HELP:

💁 You might need our help!

Reach 92,500+ Founders & Investors: Partner with our newsletter to reach a highly engaged audience.

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Do you have any news to share about your Startup or VC fund? Please email us.

We’ll be back in your inbox on Monday.