☕ Apple reportedly abandons smartwatch camera plans & Valve CEO's Neuralink rival expects first chip this year.

OnlyFans talks for $8B sale to investor group & VCs turn to AI-powered roll-ups as a new investment model.

Lightning 101: count, divide… panic.

To estimate how far away it is, count the seconds between flash and thunder.

Then, divide by 5 to get how many miles away. Basically, if you're not getting past 2... maybe go inside.

Love or hate this intro? Hit reply and tell us why!

📬 What’s in store:

Today’s Picks: Big Tech’s AI moves, AI agency trap, 2700+ US & 6000+ Euro VCs, Cursor’s rise, no-moat picking, 100T tokens, human side of engineering.

Valuation, launch tips, seed advice, pitch deck musts, financial model, VC interview, data room guide.VCs turn to AI-powered roll-ups as a new investment model.

Trump threatens 25% tariffs on iPhones made outside the US.

Microsoft unveils Aurora AI to forecast weather with speed and precision.

Apple reportedly abandons smartwatch camera plans.

Oracle to buy $40B of Nvidia chips for OpenAI data center.

Valve CEO's Neuralink rival expects first chip this year.

Nvidia to launch cheaper AI chip for China amid US export restrictions.

Musk’s DOGE team reportedly using Grok AI in U.S. government.

OnlyFans in talks for $8B sale to investor group led by Forest Road.

VC & Startup Jobs: VC & investors backed startup hiring for remote roles.

⏱️ Read Time: 3 minutes

DAILY PICKS

🗞️ What else is brewing

All-In-One Term Sheet Guide for Founders.

Beware of “Vibe Revenue” By Greg Isenberg.

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link).

Why VCs ask these odd questions (and how to answer Tthem).

The Cap Table Guide Every Founder Should Read.

The only startup valuation guide you need as a founder.

6000+ European VC Firms Contact Database (LinkedIn Links).

New report shows the staggering AI cash surge — and the rise of the 'zombiecorn'.

GPs rush to secure fund financing as uncertainty fuels liquidity fears.

Excel Template: Early Stage Startup Financial Model For Fundraising.

Do Early-Stage startups need a financial model for fundraising?

Investor data room guide & templates for founders.

Need a pitch deck that gets investor meetings? We’ve opened just 3 slots to help founders craft winning decks—built by experts, reviewed by investors. Don’t leave funding to chance—[schedule a call today →]

FROM OUR PARTNER - ATTIO

🤝 Why Next-Gen Startups Are Switching to Attio.

Attio is the AI-native CRM built for the next era of companies.

Connect your email, and Attio instantly builds your CRM - with every company, every contact, and every interaction enriched and organized.

You can also use AI research agents for complex processes like finding key decision-makers and triaging leads.

Join industry leaders like Flatfile, Replicate, Modal and more.

FEATURED YOUR STARTUP

💪 Get your startup in front of over 95,000+ audience

Our newsletter is read by thousands of tech professionals, founders, investors (VCs / Angel Investors) and managers around the world. Get in touch today.

STARTUPS RAISING MILLIONS

💰 Startup funding updates

PlaySafe ID, a London, UK-based provider of a gaming cybersecurity platform, raised $1.12M in pre-seed funding. The round was led by Early Game Ventures, with participation from Hartmann Capital and Overwolf.

Sensmore, a Berlin/Potsdam, Germany-based robotics startup, raised $7.3M in funding. The round was led by Point Nine Capital, and joined by international backers from the US and UK including Acequia Capital, Tiny Supercomputer Investment Company, Prototype Capital, and Entrepreneur First. Investors also included Amar Shah (Wayve), Michael Wax (Forto), Arnoud Balhuizen (former CCO of BHP, board member at Teck Resources), Thilo Konzok, Roby Stancel, Robin Dechant, Alexey Zhigarev, and Elmar Leiblein (former CEO of Thyssenkrupp Mining).

Slash, a San Francisco, CA-based banking platform provider, raised $41M in Series B funding, at a $370M valuation. Backers included Goodwater Capital, NEA, and Menlo Ventures, bringing the total raised to $60M.

Astrolight, a Vilnius, Lithuania-based space communications company, raised €2.8M in seed funding. The round was led by Balnord. Other investors included EIFO, Coinvest Capital, and existing investors 3NGLS and Rita Sakus.

Aniara, a Stockholm, Sweden-based AI startup improving global book publishing through automated language technology, raised its $600K in Pre-Seed funding. The round was led by Aller Media Nordic, with participation from angel investor Membriq Invest.

Siro, a NYC-based provider of an AI-powered conversation intelligence platform for in-person sales, raised $50M in Series B funding. The round was led by SignalFire, with participation from 01 Advisors, StepStone Group, and existing investors CRV, Fika Ventures, and Index Ventures.

Skriber, a Salt Lake City, UT-based medical AI scribe company dedicated to freeing healthcare providers from administrative burden, raised $1.3M in Pre-Seed funding. The round was led by SeedtoBe and Morgan Creek.

RevenueCat, a San Francisco, CA-based provider of a platform for managing consumer app monetization, raised $50M in Series C funding. The round was led by Bain Capital Ventures (BCV). Returning investors Index Ventures, Y Combinator, Adjacent, Volo Ventures and SaaStr Fund also participated.

OpenFX, a NYC-based company developing a multi-layer liquidity architecture for financial technology, raised $23M in initial funding. The round was led by Accel, with participation from NFX, Lightspeed Faction, Castle Island Ventures, Flybridge, Hash3 and strategic fintech investors.

Carrot, a Lagos, Nigeria-based digital lending startup expanding access to credit for African businesses and individuals, raised $4.2M in Seed funding. The round was led by MaC Venture Capital, with participation from Partech Africa and Authentic Ventures.

NEW VCs IN THE MARKET

🏦 Venture Capital updates

VCs turn to AI-powered roll-ups as a new investment model:

VCs like Khosla Ventures, General Catalyst, and Thrive Capital are testing a private-equity-style strategy: acquiring mature businesses (e.g., call centers, HOAs) and optimizing them with AI for scale and efficiency.

This model offers a shortcut for AI startups to access established customers and real-world datasets, solving a common challenge of long enterprise sales cycles.

Khosla Ventures is cautiously exploring the model, aiming to preserve strong returns and considering partnerships with PE firms if early deals prove successful.

KEY STORIES IN TECH

📜 Latest in tech

Trump threatens 25% tariffs on iPhones made outside the US:

Trump warned Apple it must manufacture iPhones in the U.S. or face a 25% tariff, citing dissatisfaction with production shifting to India.

The threat follows Foxconn’s $1.5B investment in India and Cook’s recent statement that most U.S.-sold iPhones will be India-made.

Trump is intensifying pressure on companies amid trade tensions, also targeting Walmart to absorb tariffs instead of raising consumer prices.

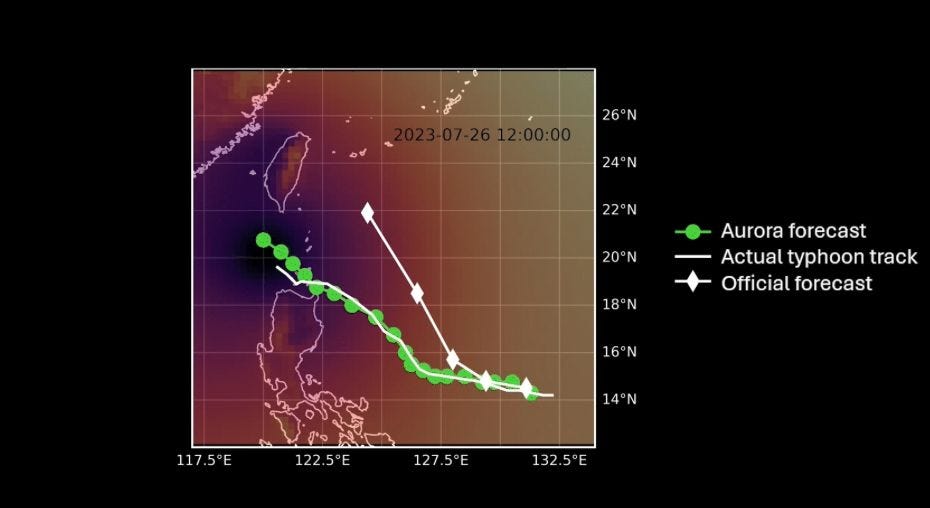

Microsoft unveils Aurora AI to forecast weather with speed and precision:

Microsoft’s new AI model, Aurora, can accurately predict weather events like typhoons, hurricanes, and air quality faster than traditional meteorological systems.

Trained on over a million hours of weather data, Aurora outperformed expert forecasts in cases like Typhoon Doksuri and five-day cyclone tracking.

Aurora's forecasts generate in seconds, and Microsoft is integrating a version of it into the MSN Weather app for real-time hourly predictions.

Apple reportedly abandons smartwatch camera plans:

People familiar with the matter at Apple state development has ended on adding a camera to its main Apple Watch and Watch Ultra models.

The company reportedly wanted to trial a camera on these smartwatch models to make better use of its planned AI features for the devices.

Previous rumors suggested a 2027 release for this smartwatch camera, which would have likely been the Series 12 and the Watch Ultra 4.

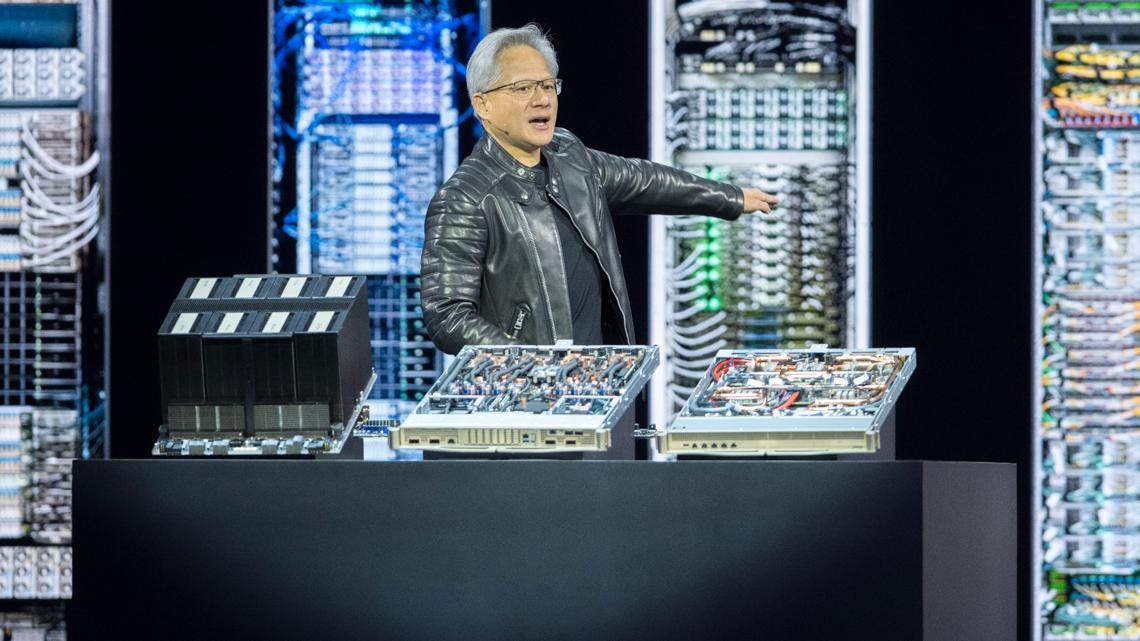

Oracle to buy $40B of Nvidia chips for OpenAI data center:

Oracle is reportedly investing around $40 billion in Nvidia chips to build a new OpenAI data center located in Abilene, Texas, for operations.

This initial "Stargate" project involves deploying about 400,000 Nvidia GB200 chips and is expected to provide 1.2 gigawatts of computing power.

Oracle will rent this computing power to OpenAI from the facility, owned by Blue Owl Capital and Crusoe, with its operations set to start mid-2026.

Valve CEO's Neuralink rival expects first chip this year:

Starfish Neuroscience, Gabe Newell's startup, revealed plans to produce its first electrophysiology chip later this year, designed for recording brain activity and brain stimulation.

The company aims for a smaller, less invasive implant than competitors, accessing multiple brain regions at once without needing an internal battery for its operation.

Starfish is also developing a precision hyperthermia device for tumors and a robotically guided transcranial magnetic stimulation system to address neurological conditions.

Nvidia to launch cheaper AI chip for China amid US export restrictions:

Nvidia plans to release a new AI chip for China, priced significantly lower than the H20, with mass production anticipated to begin as early as June.

This Blackwell-architecture processor will use conventional GDDR7 memory and avoid CoWoS packaging, featuring weaker specifications to comply with US export controls and reduce manufacturing costs.

Facing US curbs that banned its H20 model, Nvidia is developing this third tailored GPU for the nation to navigate restrictions and reclaim its diminished market share.

Musk’s DOGE team reportedly using Grok AI in U.S. government:

Elon Musk’s Department of Government Efficiency (DOGE) team is allegedly using a customized version of his AI chatbot Grok within the federal government to analyze sensitive data—potentially without proper approvals or safeguards.

Experts warn this could violate conflict-of-interest and privacy laws, especially if confidential information is exposed or used to benefit Musk’s private ventures like Tesla, SpaceX, or xAI.

Homeland Security denied any internal pressure to adopt Grok, but concerns persist over the lack of transparency and Musk’s possible access to protected federal databases.

LAST COFFEE SIP

☕Other news

OnlyFans in talks for $8B sale to investor group led by Forest Road:

OnlyFans owner Fenix International is in advanced talks to sell the company for around $8 billion, led by Los Angeles-based Forest Road Company, though other suitors and an IPO are also under consideration.

The platform, known for adult content, generated $6.6 billion in revenue in FY 2023, up from $375 million in 2020, and takes a 20% cut of creators’ earnings.

Legal concerns, including past reports of illegal content and sex trafficking, make OnlyFans a controversial acquisition target, keeping major investors cautious.

HIRING ALERT: STARTUPS & VC ROLES

💼 Today’s VC & startup job opportunities

Managing Director - Generator Accelerator | USA - Apply Here

Investment Manager - Techstar | USA - Apply Here

Venture Partner - 007 Venture Partner | USA - Apply Here

Associate - Rev1 Venture | USA - Apply Here

Investor - Griffin Gaming Partner | USA - Apply Here

Associate - Omerse Venture | USA - Apply Here

Investor Relationship Associate - Bauken Capital | USA - Apply Here

Venture Capital Junior Analyst - Stepstone Group | USA - Apply Here

Venture Capital Managing Director - Connecticut Innovation | USA - Apply Here

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs. Don’t miss this. (Access Here)

WHEN YOU’RE READY, HERE’S HOW I CAN HELP:

💁 You might need our help!

Reach 92,500+ Founders & Investors: Partner with our newsletter to reach a highly engaged audience.

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Do you have any news to share about your Startup or VC fund? Please email us.

We’ll be back in your inbox on Tomorrow.